Affirm’s latest partnership brings its alternative financing to Walmart’s U.S. stores and website

Financial technology company Affirm, which offers consumers an alternative to cash and credit when paying for large purchases, has scored a notable new partner: Walmart. The companies announced this morning that Affirm’s financing options would be made available in over 4,000 Walmart Supercenters across the U.S., and will roll out to Walmart.com in the weeks ahead.

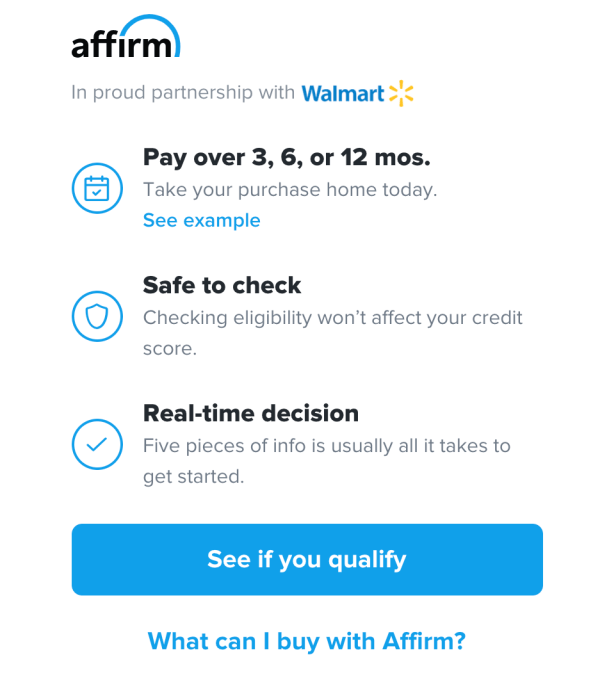

Customers will be able to check their eligibility for an Affirm loan online before heading into Walmart to shop, and then receive their decision in real-time, without a hit to their credit score. (If they move forward and use the loan, that’s when it would impact credit).

If approved, the customer can opt for a repayment term of 3, 6 or 12 month installments on purchases ranging from $200 to $2,000. Customers are also shown the exact repayment amount they’ll owe, with the interest displayed in dollars not as an interest rate. There are no other hidden fees.

Walmart’s on-store shoppers will receive a unique barcode that’s scanned at checkout by a Walmart associate, the company says.

The offering will go live across Walmart Supercenters nationwide, except in Iowa, West Virginia and Puerto Rico, and will be soon available on Walmart.com. (Some items don’t qualify for financing with Affirm, including alcohol, tobacco, groceries, pharmacy, personal care, firearms and money services.)

Before today, Affirm had partnered with Walmart-owned businesses Allswell and Hayneedle, but this deal is one of its largest to date.

The company over the past few years has focused largely on e-commerce partnerships to grow its business and today works with a number of online brands, including Casper, Wayfair, Tradesy, The RealReal, Shopify, Reverb, Betabrand, Expedia, Eventbrite, and others.

San Francisco-based Affirm, run by PayPal co-founder Max Levchin, is now one of several businesses offering consumers point-of-sale loans and installment plans along with Sezzle, Klarna, Afterpay, Square and more. These services may help people with bad credit or low credit scores make bigger purchases they couldn’t otherwise afford, as they’re unable to apply for traditional credit.

Affirm, for instance, uses its own formula for calculating risk and approving loans, which involves data science, artificial intelligence and machine learning technologies.

Affirm, for instance, uses its own formula for calculating risk and approving loans, which involves data science, artificial intelligence and machine learning technologies.

Other consumers may prefer Affirm and the like because of the flexibility of its payment plans and transparent pricing. (Affirm touts that it has no deferred interest, compounding interest or late fees, for example.)

But critics warn these businesses can hurt credit scores and entice people to overspend. They’re often referred to as modern-day loan sharks, rebranded for millennials – a generation wary of carrying credit card debt.

The company’s Gen X and younger user base could be one reason why Walmart chose to work with Affirm, as it needs a way to reach millennial shoppers.

“We are focused on providing customers transparent, easy, and convenient ways to pay, and offering Affirm both in stores and online is one way to do that,” said Daniel Eckert, Senior Vice President of Walmart Services & Digital Acceleration, in a statement. “Providing multiple ways to shop and finance select items with no hidden fees is an important way we deliver on our promise to help our customers save money and live better,” he added.

from https://techcrunch.com/2019/02/27/affirms-latest-partnership-brings-its-alternative-financing-to-walmarts-u-s-stores-and-website/

No comments: