CaptivateIQ raises $100M at a $1.25B valuation to help companies design customized sales commission plans

Less than 10 months after raising a $46 million Series B, CaptivateIQ announced today that it has raised $100 million in a Series C round at a $1.25 billion valuation.

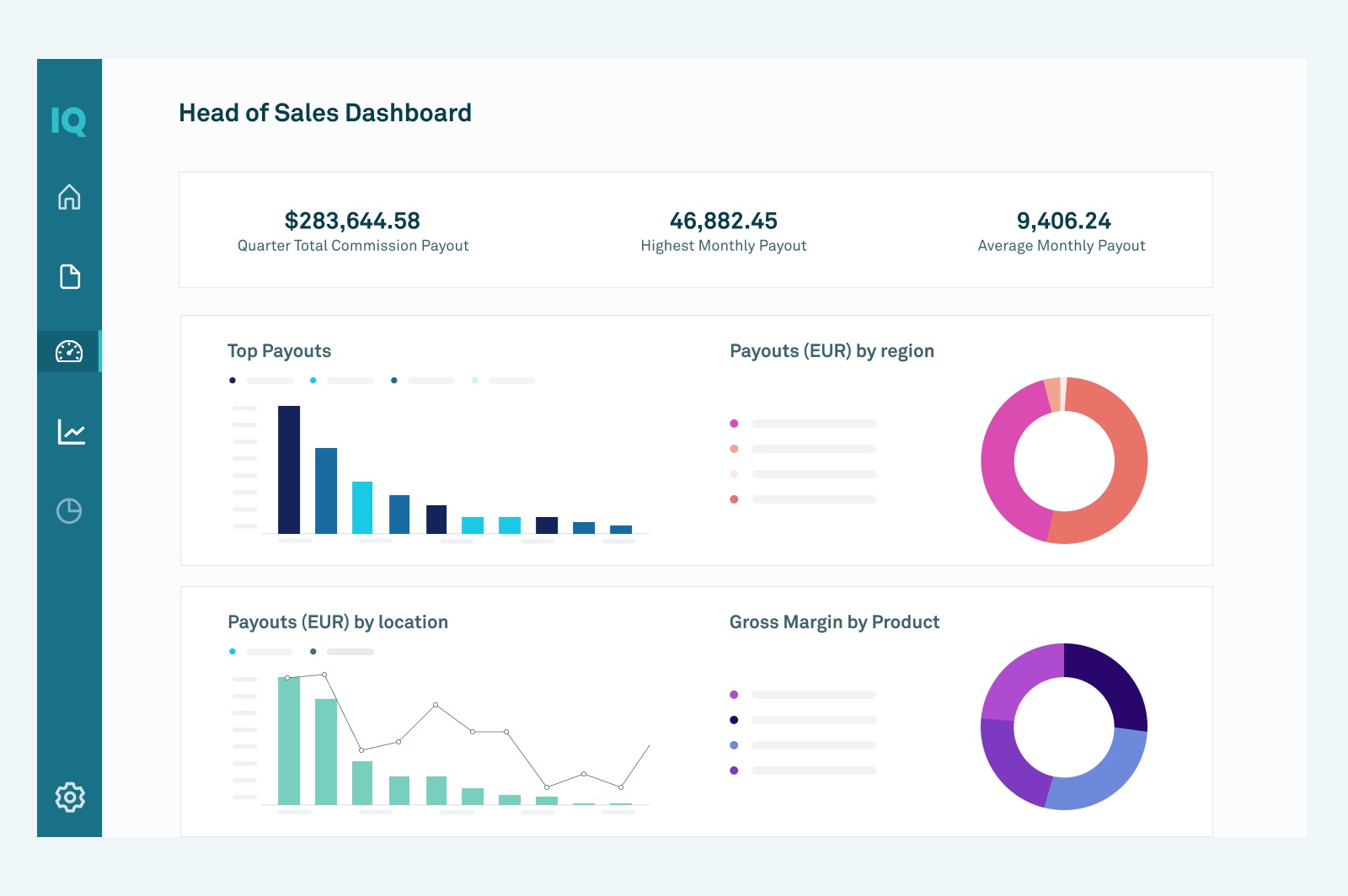

The San Francisco-based startup, which has developed a no-code SaaS platform to help companies design customized sales commission plans, says it “more than tripled” its revenue compared to the year prior, although it declined to provide hard revenue figures.

A trio of firms co-led CaptivateIQ’s latest investment, including ICONIQ Growth and existing backers Sequoia and Accel. Sapphire Ventures also joined as a new investor in the financing, which brings the company’s total funding raised to date to $164.6 million.

CaptivateIQ’s customer base includes “hundreds of organizations across industries and continents,” including more than a quarter of the Forbes’ Cloud 100 and Affirm, Amplitude, ClassPass and Podium.

CaptivateIQ was founded in the winter of 2017 and came from Y Combinator’s Winter 2018 batch. In a nutshell, CaptivateIQ is part of a new wave of Incentive Compensation Management (ICM) solutions that have sprung up in recent years to help companies automate and improve the “complex” task of designing, processing and reporting commissions, according to Mark Schopmeyer, co-founder and co-CEO.

“Sales compensation represents the single largest go-to-market investment for most B2B companies, making commissions a mission-critical process for businesses,” he said. “However, managing commissions is difficult, and companies have been forced to choose between two suboptimal choices for the process — manual, opaque and error-prone spreadsheets or rigid and costly legacy solutions.”

Those legacy solutions, Schopmeyer contends, can only handle specific types of commission plans and require users to learn “arcane” programming languages.

“They are also often cost prohibitive with implementation fees in the six-figure range,” he said.

Image Credits: CaptivateIQ

In his view, CaptivateIQ alleviates these pain points by taking the flexibility of spreadsheets and combining it with the scalability and performance of software technology to configure commissions plans with minimal support.

“Calculating commissions is really complicated and mission-critical — think of it like a very complicated form of payroll — each company has a unique commission plan that involves a lot more calculations and data than your typical salary payroll math,” co-CEO Conway Teng told me at the time of the company’s last raise. “Also, in recent years, companies have access to more data than ever, giving them room to incentivize employees on more performance metrics.”

For now, the company is in growth mode and focused on investing in the product, R&D and “building a great team,” Schopmeyer said.

Speaking of which, CaptivateIQ has more than 200 employees, up from about 90 at the time of its Series B in April of 2021.

For his part, ICONIQ Growth General Partner Doug Pepper believes the market opportunity in sales commissions is “enormous.”

“Unlike spreadsheets and legacy solutions, CaptivateIQ is extremely powerful and flexible, capable of adapting to diverse compensation plans and sales organizations as these organizations scale,” he wrote via email. “At the same time, the product strategically preserves familiar features of spreadsheets that makes using the platform highly intuitive to users.”

No-code is having a moment. Last week, Walnut, a company that creates sales and marketing demo experiences, announced a $35 million Series B financing. And Softr, a Berlin-based startup that lets customers build apps atop Airtable databases, recently raised $13.5 million in a Series A round.

from https://techcrunch.com/2022/01/26/captivateiq-raises-100m-at-a-1-25b-valuation/

No comments: