Spotify exits short-lived Car Thing hardware play, reports Q2 MAUs of 433M, offsetting Russia exit and service outage

Spotify’s push to complement its music streaming with a big move into podcasting and related content appears to be paying off, despite the ups and downs of operating in an uncertain economic and political climate and Spotify’s exit from its foray into hardware. Today the company announced quarterly earnings in which its monthly active users grew by 19%, or 19 million, to 433 million — 5 million above its own guidance. The company originally had projected that its exit from Russia and the service outage it had in the quarter would mean only 14 million new users this quarter. Paid users now stand at 188 million, up 14%.

But it missed on its gross margins, which it said were “negatively impacted by our decision to stop manufacturing Car Thing,” the company’s in-vehicle device for controlling music. Spotify’s taking a €31 million charge ($31.4 million) on that business line as it discontinues it.

“The goal of Spotify’s Car Thing exploration was to better understand in-car listening, and bring audio to a wider range of users and vehicles,” a spokesperson told TechCrunch. “Based on several factors, including product demand and supply chain issues, we have decided to stop further production of Car Thing units. Existing devices will perform as intended. This initiative has unlocked helpful learnings, and we remain focused on the car as an important place for audio.”

The device was only really launched earlier this year, and it is still being sold as of this story going out, but with big discounts. Spotify will support those that have been sold, but it seems that this will be the end of the line for Spotify’s much-discussed move into hardware. Spotify noted that the costs associated with Car Thing were partially offset by a positive change in prior period estimates for rights holder liabilities. Gross margin dropped to 24.6% from 28.4% a year ago, and missed Spotify’s own estimates of 25.2% for it.

Spotify overall beat its own estimates for sales and earnings, but it continues to remain unprofitable. Its net loss in the quarter was $197 million (€194 million), on sales of $2.9 billion (€2.864 billion).

Podcasts remain a bright spot for the company. Spotify noted that it now has 4.4 million podcasts on the platform, and that “the number of MAUs that engaged with podcasts grew in the substantial double-digits year on year and per user podcast consumption rates continued to rise.”

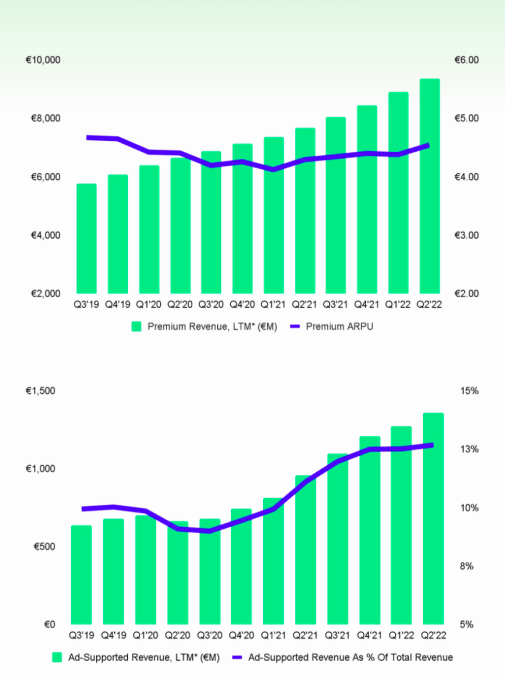

The company has been pushing deeper into advertising for its free user base, and it noted that its ad-supported percentage of total revenue was at an all-time high. Looking at the table of previous quarters, however, you can see that overall revenues are still growing a lot faster than advertising is, so the bigger question will be wether the costs of supporting that ever-larger base can be balanced out against incoming sales. Premium ARPU, the top graphic, is similarly seeing a widening gap compared to overall premium revenues, although Spotify noted that some of that has been offset by price increases for subscriptions:

from https://techcrunch.com/2022/07/27/spotify-exits-short-lived-car-thing-hardware-play-as-reports-q2-maus-of-433m-offsetting-russia-exit-and-service-outage/

No comments: